Content

Forensic business bookkeeping is a specialty practice area of accounting that describes engagements that result from actual or anticipated disputes or litigation. “Forensic” means “suitable for use in a court of law”, and it is to that standard and potential outcome that forensic accountants generally have to work. Both the words accounting and accountancy were in use in Great Britain by the mid-1800s, and are derived from the words accompting and accountantship used in the 18th century. In Middle English the verb “to account” had the form accounten, which was derived from the Old French word aconter, which is in turn related to the Vulgar Latin word computare, meaning “to reckon”. The base of computare is putare, which “variously meant to prune, to purify, to correct an account, hence, to count or calculate, as well as to think”.

It does not matter if you were not planning on pursuing a career in accounting or finance. It is very useful for small business owners to know some fundamentals of accounting. This article is designed to help small business owners get some fundamentals in accounting to ultimately help them run their businesses effectively. Explain how accounting principles affect financial statement analysis. Explain the key principles of double-entry bookkeeping and accrual accounting. Identify 6 accounting concepts and explain them give two examples of each.

Conclusion – Debits and Credits

This information is used by different internal and external users of the organization for various purposes regularly. The financial statements are prepared regularly because it helps them in the decision-making process, and no firm can wait for long to know its results. The normal interval for the preparation of the financial statements is one year. This time interval of one year is known as the accounting period. According to the Companies Act, 2013 and the Income Tax Act, an organization has to prepare its income statements annually. However, in some cases, like the retirement of a partner between the accounting period, etc., the firm can prepare interim financial statements.

What are the 4 principles of GAAP?

The four basic constraints associated with GAAP include objectivity, materiality, consistency and prudence. Objectivity includes issues such as auditor independence and that information is verifiable.

A fixed cost is a cost that stays the same regardless of increases or decreases in a company’s output or revenues. Examples include rent, employee compensation, and property taxes. The term is sometimes used alongside “operating cost” or “operating expense” . OPEXs describe costs that arise from a company’s daily operations.

What Is Revenue? A Quick Refresher

Revenue is said to have been realised when cash has been received or right to receive cash on the sale of goods or services or both has been created. L This concept requires asset to be shown at the price it has been acquired, which can be verified from the supporting documents. L A business is judged for its capacity to earn profits in future. To explain this equation in more detail, imagine buying a house. Let’s say you bought house sold for $300K with an 80% mortgage ($240K) a 20% down payment ($60K). The tracking of business activities and vision for handling any unforeseen financial situations should be taken into account while aiming for consistency.

- Examples include rent, employee compensation, and property taxes.

- Again, these terms are merely an introduction to business accounting.

- Regardless, you’ll need to understand and secure a payroll system.

- Since financial management and accounting plays an important role in every business organisation, it is important to stay abreast of basic accounting concepts which can be incorporated.

- In others, tax and regulatory incentives encouraged over-leveraging of companies and decisions to bear extraordinary and unjustified risk.

Double-entry bookkeeping was pioneered in the Jewish community of the early-medieval Middle East and was further refined in medieval Europe. With the development of joint-stock companies, accounting split into financial accounting and management accounting. Only accounting concept accepted by external auditors if they need to inspect your financial statements. Because cash is an Asset you need to debit increases and credit decreases.

Materiality Concept

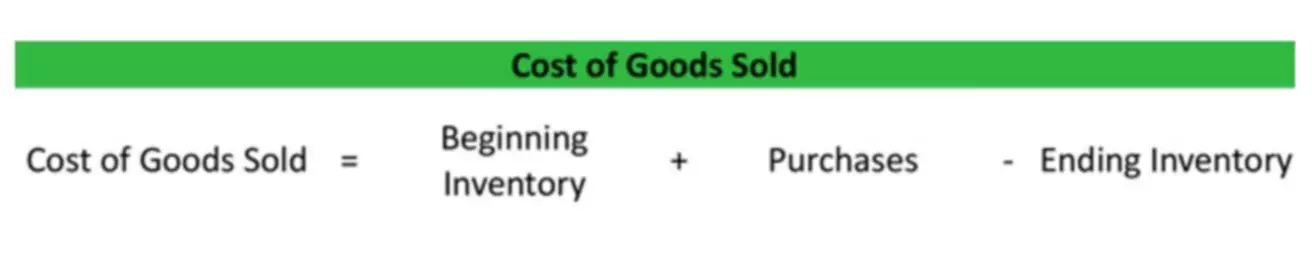

For example, let’s say your company pays $5,000 in rent each month. Here’s how that would be recorded in your financial records before that amount is paid out. A debit is a record of all money expected to come into an account. A credit is a record of all money expected to come out of an account.