Contents:

Trading is not performed at the moment of increased volatility or during a flat period. To make this decision, you need to understand if volatility is elevated or not. Open the volatility calculator on the Investing website and compare the amplitude of movement for the day with the average value.

This type of trading strategy is particularly popular with retail and institutional traders that hope to profit from small price movements and short-term trends. A trader’s approach is determined mainly by the time frame chosen. For instance, day traders often find the 20-period moving average practical due to its shorter time frame. Elsewhere, the 200-period moving average is better for long-term traders who can patiently monitor the trends. The MA still acts to give a trader a great indication of support and resistance levels. These indicators move or oscillate between two limits to gauge the trend’s strength and momentum.

As time went on, simple became my mantra and as a result, my trading decisions were clearer and were made with much less confusion and stress. Find strong levels, enter trades when the price breaks them out or rebounds. Refer to reversal patterns, confirming the trend reversal. CFDs are traded in the Forex market, which is the OTC market.

If a stock finishes near its high, the indicator gives volume more weight than if it closes near the midpoint of its range. The different calculations mean that OBV will work better in some cases and A/D will work better in others. RSI is a momentum oscillator which was used by Welles Wilder.

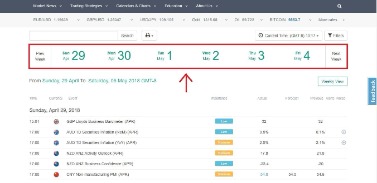

Short-term trading software

In other cases, the trend direction is forecast accurately. It is also clear that Parabolic SAR lags by 2-5 candlesticks. X is the number of periods, k is the step of the price change. The MA is a frequently used indicator to analyze the long-term market trend in daily and weekly intervals. K is the weight coefficient, taking into account the smoothing period.

- If both lines are below -1.5 and start turning up, it is a buy signal.

- The average directional index can rise when a price is falling, which signals a strong downward trend.

- Swing trade participants who prefer to engage in swing trading often enter the market at prices that are not the best.

Trend analysis is a technique used in technical analysis that attempts to predict future stock price movements based on recently observed trend data. Many skilled traders have found that combining the right indicators in different market conditions gives them a more accurate trading experience. Since market conditions continually change from ranging to trending and back again, you can use each indicator to your own advantage according to its strength. For instance, the price of a crypto asset under consideration would likely bounce off a Fibonacci support level during a completed uptrend. Also, the resistance level could be an excellent point to take profit and close a trade in the expectation of a reversal.

Moving Average Convergence/Divergence (MACD)

There will work indicators suitable for stock trading. ADX. The ADX indicator shows the strength of bulls and bears; it can indicate an acceleration or a slowdown of the price movement. The indicator builds the key levels where the trend could reverse.

The parabolic SAR is a popular indicator used in technical analysis to determine the price at which momentum has changed. The Parabolic SAR can be seen as an improvement on traditional moving average crossover systems because of its more intuitive approach for determining signal changes. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market.

A retracement is when the market experiences a temporary dip – it is also known as a pullback. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Inflation can have a big impact on the stock market, leaving unprepared investors in for a bumpy ride. In this article, we’ll explain why inflation impacts the stock market and take a closer look at how the stock market has reacted to inflation in the past.

Technical Indicators for the Stock Market – FX Leaders Stock Signals – FX Leaders

Technical Indicators for the Stock Market – FX Leaders Stock Signals.

Posted: Mon, 06 Feb 2023 09:10:36 GMT [source]

According to Elder, the moving average is an agreement between buyers and sellers on the asset price over a fixed period, satisfying both parties. The current deviation of the MA means a rise in the power of bulls or bears. In the basic version, the indicator is based on the EMA . It is one of the best day trading indicators for beginners.

Example of short-term stock trading

Make profits from a trending movement by determining its beginning and confirm the entry signal with oscillators. Oscillators will also help you spot potential trend reversal points. Test the indicator on a demo account in all kinds of market situations, determine the moments when the signals are the most accurate. For example, there are indicators that do not work in trading flat or in minute timeframes.

Alligator is a trend indicator based on moving averages. The wider the distance between the MAs, the stronger the price momentum. When the lines are meeting together, the trend is exhausting.

https://g-markets.net/ following strategies, which consider trade volumes. It is used as a complementary tool together with trend indicators and oscillators. The OBV is recommended to professional traders who prefer stock market instruments. It is less useful in Forex and performs worse than other oscillators in terms of signal accuracy and interpretation. Chaikin Volatility Indicator measures the volatility based on the range between extreme price values. The tool is based on the idea that the volatility declines during a correction and increases when the trend starts.

The tool is used only for the market analysis in combination with primary and confirmation tools. The tools will be of interest to beginner traders, who learn to spot the rise in market volatility and try to employ trading strategies based on the volatility changes. The channels are built along with the extreme points of the price deviation from the average value.

MACD Indicator: What Is and How to Use in Forex Trading

During uptrends, a stock will often hold above the 30 level and frequently reach 70 or above. When a stock is in a downtrend, the RSI will typically hold below 70 and frequently reach 30 or below. The most basic use of an RSI is as anoverboughtandoversoldindicator.

Are things trending up over the past 10 days, or are they trending down? And fortunately for you, VectorVest simplifies this, too. Following these patterns requires validation of their strength through volume indicators. Once you see a hammer, for example, you should watch for a rise in trading volume to confirm the pattern before entering.

Solana: Here’s what traders should watch out for in the short-term – AMBCrypto News

Solana: Here’s what traders should watch out for in the short-term.

Posted: Thu, 02 Mar 2023 08:33:08 GMT [source]

And the impact of these costs on the result is lower because short term trading indicators traders work with larger market movements than day traders. Thus, classic swing trading is based on technical analysis, and its basis is the understanding of graphical analysis and trading volume analysis. Also, swing traders use indicator analysis if necessary, and sometimes fundamental analysis as well . Moving Average Convergence Divergence is, per definition, a trend-following momentum oscillator that helps traders identify the formation of a new strong trend.